Driving Clean Energy

The global energy sector is undergoing a transformation that is driving sustainable, inclusive economic growth. Abt is working with governments, utilities, and investors to craft policies and enable partnerships that increase penetration of renewables in energy systems, enhance resilience of power infrastructure, and enable greater access to affordable, reliable clean energy that unlocks countries’ economic potential.

Strengthening the Enabling Environment: Energy Planning, Policy, and Incentives

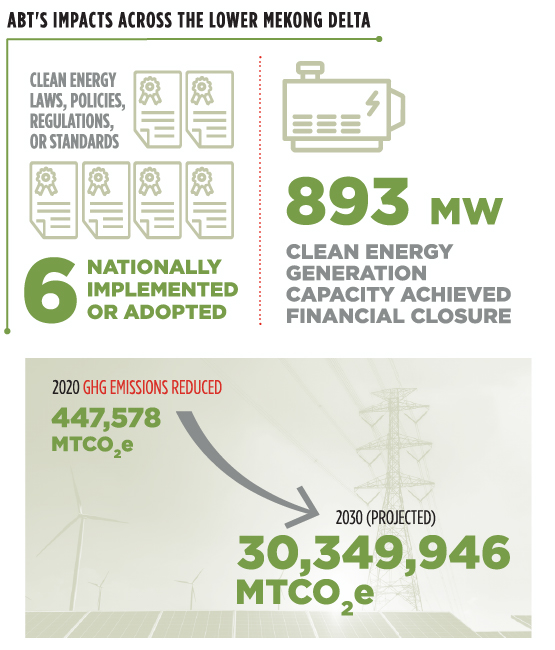

In the Lower Mekong Delta, distributed photovoltaics (DPVs), such as rooftop solar power generation, are particularly well suited for expansion in this region, given reduced costs (a decline of more than 55 percent in less than five years), reduced emissions, increased energy security, and greater reach and functionality at scale. Yet DPV installed capacity, utility-scale solar, and other renewable energy (RE) uses remain far below their potential, due in part to insufficient policies and regulations.

Across Cambodia, Laos, Thailand, and Vietnam, we are accelerating a transition to a high-performing, low-carbon power sector. By strengthening the policy and investment enabling environment, training and convening key stakeholders, and delivering rigorous technical analyses, we are helping to set and realize ambitious renewable energy targets across the region.

In the Philippines and Thailand, Abt evaluated the economic and technical implications of DPV deployment. The studies provided data to inform policymakers’ and regulators’ efforts to achieve a balance between incentivizing DPV investments and understanding potential impacts on distribution utilities, non-DPV customers, and the distribution grid.

In Vietnam, we leveraged our DPV work in the Philippines and Thailand to support the adoption of a comprehensive solar incentives policy, Decision 13, in April 2020. Decision 13 puts in place mechanisms to encourage the development of solar power projects and unleashes the ability of private developers and other key actors to generate and purchase solar power in Vietnam. Through the support of programs implemented in Vietnam and government policy updates, we have seen DPV installed capacity rise from just 1 MWp in 2018 to 812 MWp as of December 2020.

In Laos, we are pioneering two approaches to boost utility-scale solar and other RE uses: RE zones and solar auctions. The establishment of RE zones facilitate access to the highest-quality resources to diversify generation and meet the growing demand for RE mix. These zones will reduce energy prices and costs of common infrastructure, in addition to reducing uncertainty and risk to developers. Solar auctions will increase utility scale through a competitive, transparent procurement process. Abt is working closely with relevant agencies and partners to develop the mechanisms needed to facilitate the solar pilot auction design and bidding process.

Emerging Technology and Innovation

Battery Energy Storage Systems (BESS)

With BESS, utilities can store excess energy from solar and other intermittent sources to have available when needed. An Abt study examined how to incorporate BESS into technology-neutral auctions and distributed energy roadmaps, which guide the modernization of power grids in emerging markets. This insight will help USAID to support cost-effective rapid deployment and implementation of such technology. Abt has also provided direct support to the Government of Thailand to develop BESS technical standards and reduce bottlenecks for when deployment of this technology increases.

Client: U.S. Agency for International Development (USAID)

Projects: Climate Economic Analysis for Development, Investment and Resilience (CEADIR); Clean Power Asia

Lithium-ion Battery Cells for Electric Vehicles

We conducted a total lifecycle assessment of the C4V Generation-1 lithium-ion battery, from material extraction to completed battery cell. This first-ever “cradle-to-gate” assessment indicated that C4V’s battery is potentially the greenest battery on the market.

Client: New York State Energy Research and Development Authority (NYSERDA)

Project: Life Cycle Assessment: C4V Lithium-Ion Battery Cells for Electric Vehicles

IDbox

In Papua New Guinea, we piloted a solar-powered device that creates unique personal identification through a combination of fingerprints and mobile phone texting to use in voting, remittances, and health care services. Through solar power, this technology improves governance and social inclusion, in particular among remote populations without prior access to formal markets and government services.

Client: Australian Government Department of Foreign Affairs and Trade (DFAT) and PNG-Australia Governance Partnership

Project: Economic Governance and Inclusive Growth Partnership (EGIG)

Client

U.S. Agency for International Development (USAID)

Project

Clean Power Asia

Advancing U.N. Sustainable Development Goals

[click tab above to open]

Unlocking Clean Energy Finance

In the United States, cities and states have many options for financing climate and energy projects, including new and innovative strategies such as green banking and green bonds. However, these strategies are complex, and state and local governments often struggle to determine if they are suited to their particular needs. To address this, we developed finance primers that enable states and local governments to understand how various financing mechanisms work, what the advantages are, and whether they are a good fit. We produced these primers for the U.S. Environmental Protection Agency (EPA), along with webinar trainings and testimonials from states and cities that are using these strategies successfully.

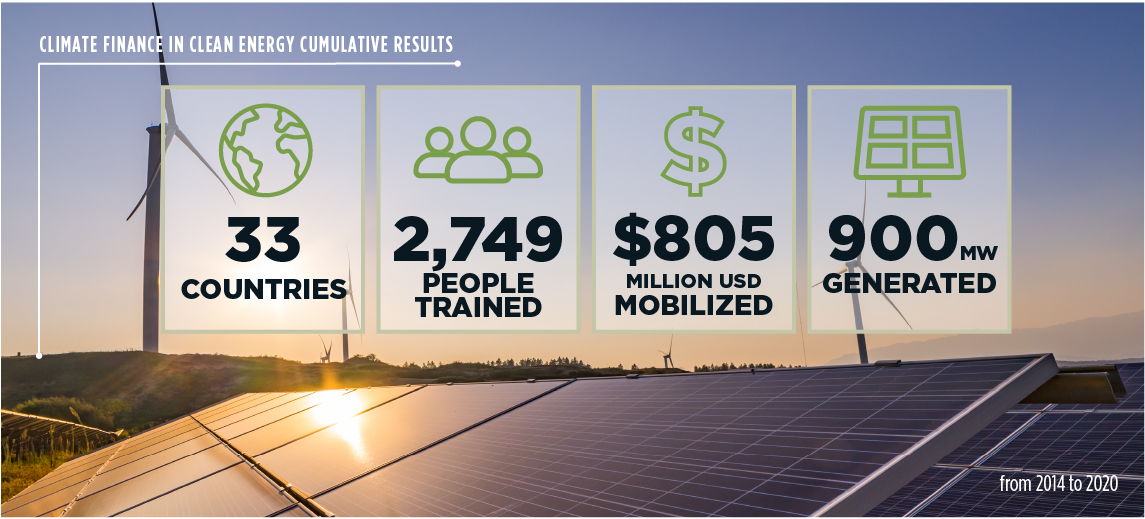

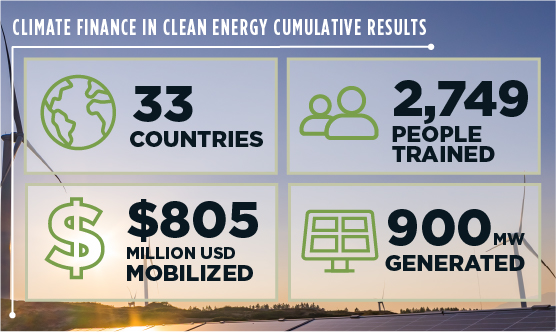

Across developing countries many significant barriers exist to financing clean energy, including investment, lack of technical capacity, and institutional and policy obstacles. Financial institutions overestimate risks and underestimate economic returns when it comes to clean energy opportunities. Our work encourages increased private investment in clean energy by leveraging private capital and breaking down barriers and perceived risks.

In 33 countries across Africa, Asia, Latin America and the Caribbean, Abt has helped make the business case for clean energy, sustainable landscapes, and adaptation.

In West Africa, we provided technical assistance to 43 banks to increase lending through PAYGO—an innovative finance mechanism that allows end-users to pay for solar energy in incremental time units, removing financial barriers of having to pay for the entire solar system upfront—as well as lending for rooftop solar, mini-grid, and energy efficiency projects. In Ghana, our work leveraged $6.6 million in local financing for off-grid RE projects, which will add a projected 1,467 on-grid and off-grid direct connections and 6.8 MW in generation capacity.

In Central America, we assessed the potential market for renewable energy and trained nearly 1,300 bank employees—more than half women—in climate finance. In El Salvador, we supported the former Development Credit Authority’s (DCA)—now part of the U.S. International Development Finance Corporation—approval of a 15-year guarantee for $10.8 million in lending for clean energy, which marked the first time a DCA loan had been used for clean energy in Central America. By late 2018, two banks in Guatemala and one in Honduras also had DCA guarantees for clean energy lending.

Across Cambodia, Laos, Thailand, and Vietnam, we are encouraging power-sector investments in clean energy sources, including bringing more renewable energy into the grid. We have improved planning tools, fostered supportive policies, and mobilized the private sector. More than 600 developers and bankers have been trained in project finance and modelling to invest in solar and wind technologies. To date, $788 million has been invested to achieve 893 MW in renewable energy.

Client

U.S. Environmental Protection Agency (EPA)

Projects

Clean Energy Finance: On-bill Programs; Clean Energy Finance: Green Banking Strategies for Local Governments

Client

U.S. Agency for International Development (USAID)

Projects

Climate Economic Analysis for Development, Investment and Resilience (CEADIR); Clean Power Asia

Advancing U.N. Sustainable Development Goals

[click tab above to open]